Two proposed initiatives aimed at reforming homeowner insurance regulations in California have been withdrawn, effectively maintaining the protections established by Proposition 103. This decision underscores the ongoing challenges posed by wildfire risks and a volatile insurance market in the state.

The initiatives, one spearheaded by Consumer Watchdog and the other by insurance broker Elizabeth Hammack, sought to address the significant obstacles homeowners face amid increasing wildfire threats. The withdrawal of both measures preserves the consumer protections embedded in Proposition 103, a landmark law passed in 1988 that granted power to an elected insurance commissioner to regulate rate hikes.

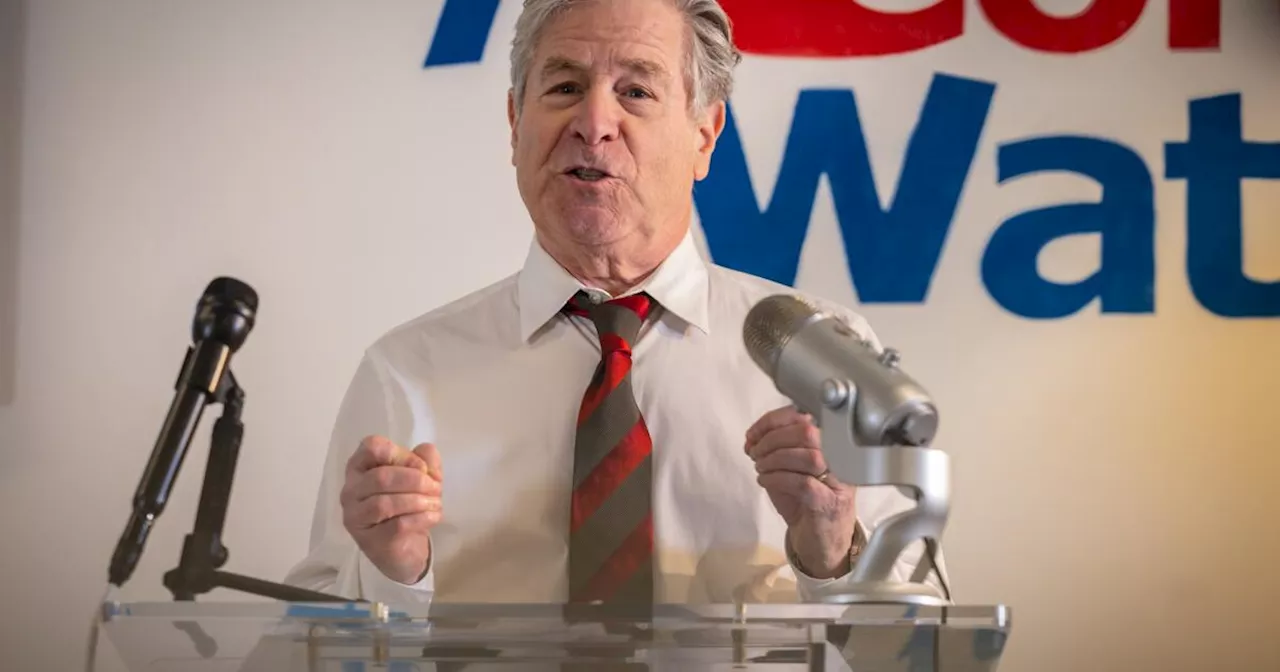

The withdrawal reflects a strategic decision influenced by financial limitations, differing reform visions, and a shared recognition of the complexities surrounding the insurance landscape. Consumer Watchdog, founded by Harvey Rosenfield, the original author of Proposition 103, cited insufficient funding as the primary reason for abandoning its ballot measure. The group emphasized the urgent need for protections, particularly for homeowners meeting state wildfire mitigation standards.

Similarly, Hammack withdrew her proposal, the California Insurance Market Reform and Consumer Protection Act of 2026. This initiative aimed to introduce substantial changes, such as permitting insurer premium increases to take effect prior to rate reviews, along with potential suspensions if market conditions were deemed uncompetitive. Additionally, it sought to offer premium credits for homeowners who actively reduce fire hazards and eliminate payments to intervenors like Consumer Watchdog—an element that has long sparked contention within the industry.

The mutual withdrawal of these initiatives signals a temporary cessation in the contentious debate over insurance reform. Insurance Commissioner Ricardo Lara has previously proposed regulations to tighten reimbursements and other rules pertaining to intervenors, reflecting the delicate balance among the interests of consumers, insurers, and regulators in a state grappling with escalating wildfire risks.

The context of this situation is critical. Homeowners in fire-prone areas have faced significant challenges in securing insurance, particularly following a series of catastrophic wildfires. Many insurers have either canceled existing policies or ceased writing new ones, highlighting substantial limitations within the current insurance market.

Although Commissioner Lara has attempted to alleviate the crisis by incentivizing insurers to offer policies through various concessions, these efforts have yet to significantly decrease reliance on the California FAIR Plan, a state-backed insurance pool designed for last-resort coverage. The FAIR Plan has seen a sharp increase in active dwelling policies from 2021 to 2024, raising concerns about its financial sustainability and the broader implications for homeowners seeking coverage.

The need for a long-term strategy to ensure the availability and affordability of homeowner insurance in California is becoming increasingly urgent, especially as climate change exacerbates the frequency and intensity of wildfires. The state’s focus is now shifting towards exploring alternative solutions and policy adjustments to address the challenges faced by both consumers and insurers in this evolving landscape.

Hammack expressed disappointment over the title and summary assigned to her measure for the ballot, stating that consumers would continue to be burdened by outdated regulations. As California navigates these turbulent waters, the path forward remains uncertain, but the dialogue surrounding insurance reform is likely to persist as stakeholders seek viable solutions to protect homeowners.