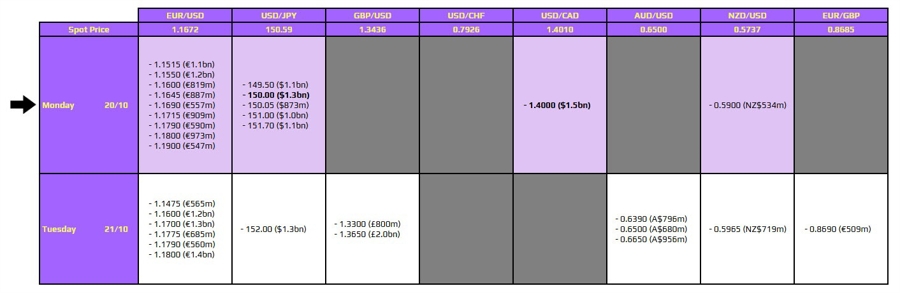

URGENT UPDATE: FX option expiries are set for October 20, 2023, at 10 AM New York time, with critical movements expected in currency pairs, particularly USD/JPY and USD/CAD.

As the market opens today, traders are keenly watching the USD/JPY, which hovers near the pivotal 150.00 mark after breaking below that threshold last Friday. The pair’s performance is now influenced by major political developments in Japan. The ruling Liberal Democratic Party (LDP) is poised to partner with Nippon Ishin, potentially paving the way for Takaichi to ascend as the next Prime Minister.

This anticipated leadership shift could stabilize the yen, but Takaichi’s reputation as a fiscal dove raises concerns for investors, complicating the pair’s outlook. The expiries at the 150.00 level may act as a buffer against significant declines, while resistance is expected closer to 151.00, aligning with the 100-hour moving average.

In addition, FX traders should monitor expiries for USD/CAD at the 1.4000 level, which, despite lacking technical significance, could restrain further downward movement for the pair amid a recent drift lower since the end of last week.

The latest updates signal a critical juncture for these currency pairs, and traders are advised to stay alert as the market reacts to these developments. As always, for deeper insights and strategies on navigating the FX landscape, visit investingLive (formerly ForexLive).

Be prepared for heightened volatility as these expiries roll off, and remain vigilant for any additional news that could impact trading today. Stay tuned for more updates as the situation unfolds!