D.R. Horton, Inc. has seen a downward revision in its earnings estimates for the first quarter of 2026, as analysts at Zacks Research reported on November 11, 2023. The construction company is now projected to earn $1.94 per share, a significant drop from the previous estimate of $2.43. This adjustment comes amidst broader analyses of the company’s financial performance.

In addition to the Q1 revision, Zacks Research provided new earnings expectations for subsequent quarters. The estimates include $2.50 for Q2 2026, $3.38 for Q3 2026, and $3.60 for Q4 2026. The full-year earnings forecast for 2026 has also been adjusted to $11.41 per share, while Q1 2027 earnings are now estimated at $2.27 and Q4 2027 at $3.90.

Several investment firms have responded to recent developments surrounding D.R. Horton. UBS Group recently raised its price target on the company’s shares from $187.00 to $195.00, maintaining a “buy” rating. Similarly, Wells Fargo & Company increased its target price from $175.00 to $190.00 and assigned an “overweight” rating. Other firms, including Citigroup and Evercore ISI, have also weighed in, offering ratings that range from “buy” to “neutral.”

Despite the lowered earnings estimates, D.R. Horton has received a mixed rating from analysts. Currently, one analyst rates the stock as a “Strong Buy,” six have assigned a “Buy” rating, six have indicated “Hold,” and two have issued a “Sell” rating. According to data from MarketBeat, the average consensus rating for D.R. Horton is “Hold,” with a target price of $157.38.

On November 9, 2023, shares of D.R. Horton traded at $143.39, reflecting a 50-day moving average of $160.71 and a 200-day moving average of $145.68. The company has a market capitalization of $42.75 billion and a price-to-earnings (P/E) ratio of 12.37. Over the past year, the stock has fluctuated between a low of $110.44 and a high of $184.54.

D.R. Horton recently reported its earnings results for the fourth quarter of the fiscal year on October 28, 2023. The company posted earnings of $3.04 per share, missing analysts’ expectations of $3.29 by $0.25. Despite this shortfall, D.R. Horton achieved revenues of $9.68 billion, exceeding projections of $9.44 billion. Compared to the same quarter last year, quarterly revenue showed a decline of 3.2%.

In the context of institutional investment, several hedge funds have recently adjusted their positions in D.R. Horton. Notably, Concord Wealth Partners acquired a new stake valued at approximately $25,000, and Canton Hathaway LLC invested around $26,000. Institutional investors currently hold 90.63% of the company’s shares.

In other corporate news, David V. Auld, Chairman of D.R. Horton, sold 30,000 shares at an average price of $182.21 on September 5, 2023, amounting to a total of $5,466,300. Following this transaction, Auld retains ownership of 815,672 shares. This sale represents a 3.55% decrease in his stake. Additionally, Senior Vice President Aron M. Odom sold 1,376 shares that same day, reducing his ownership by 17.57%.

In positive news, D.R. Horton announced an increase in its quarterly dividend, which will rise from $0.40 to $0.45 per share. This dividend will be paid on November 20, 2023, to stockholders of record as of November 13, 2023. The annualized dividend now stands at $1.80, yielding 1.3%, with a payout ratio of 15.53%.

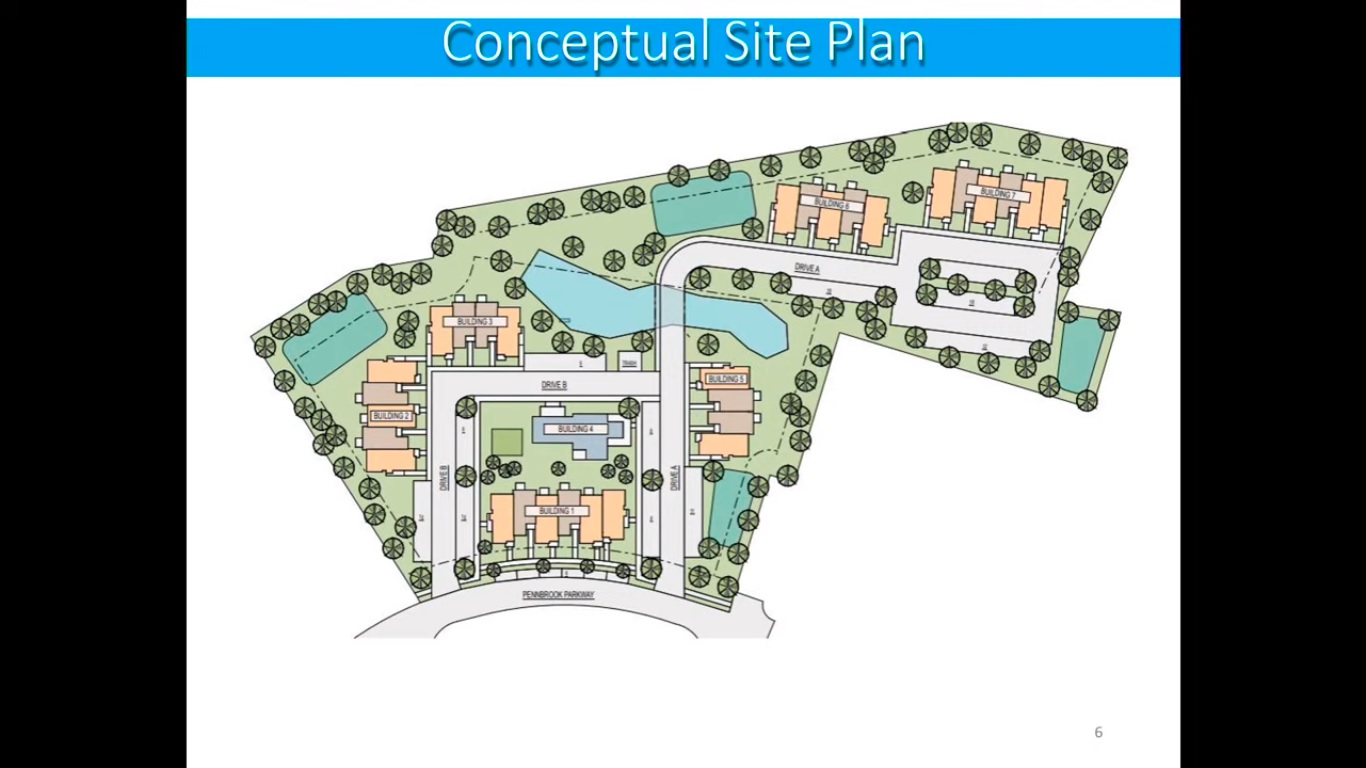

D.R. Horton operates as a leading homebuilding company across various regions in the United States, engaging in land acquisition, development, and the construction and sale of residential homes. The company operates in 118 markets across 33 states, catering to diverse housing needs.