UPDATE: Nvidia’s stellar Q3 earnings have just triggered a massive surge in tech stocks, reviving investor confidence in the AI sector. Following the chipmaker’s blockbuster results, shares jumped 5%, sparking a rally across the technology landscape.

At the market open on Thursday, October 19, 2023, major indices reflected this renewed optimism: the Nasdaq soared over 2%, the S&P 500 climbed 1.5%, and the Dow Jones Industrial Average rose by 521 points.

Nvidia reported an astonishing $57 billion in revenue for the quarter, marking a 62% year-over-year increase. The company’s data center business alone generated $51.2 billion, up 66% from the previous year. The firm also projected $65 billion in revenue for the upcoming quarter, exceeding analysts’ expectations of $61 billion.

This surge in confidence comes after weeks of hesitation among investors over high valuations and significant capital expenditures in AI. Nvidia’s impressive performance has calmed many fears about the sustainability of AI demand. “It has been many decades since one stock could move the market like Nvidia,” stated David Rosenberg, president of Rosenberg Research, emphasizing the impact of this singular company on the overall market.

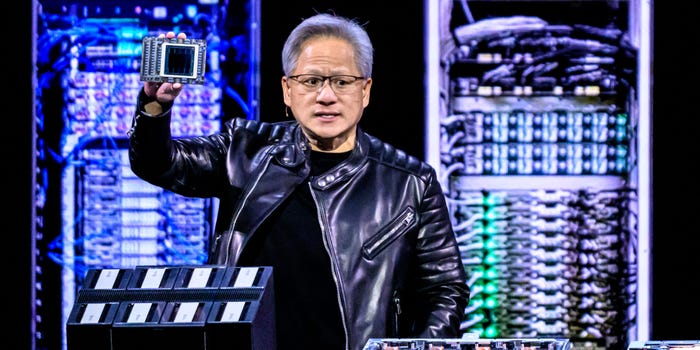

Investors are reacting positively to CEO Jensen Huang’s insights shared during the earnings call, which analysts described as exactly what tech bulls needed to hear. “In a nutshell, there is one company in the world that is the foundation for the AI Revolution, and that is Nvidia,” said Dan Ives of Wedbush Securities.

Despite the optimistic trends, some analysts caution against potential risks. Rosenberg warned, “This remains a bubble of epic proportions,” expressing skepticism about the projected growth of the AI market. He cautioned that the valuation assigned to AI assets might not be sustainable and could lead to significant market corrections in the future.

As Nvidia continues to lead the charge in the AI space, the ramifications of its performance are being felt across the tech sector, lifting companies like Super Micro Computer by 6.4%, Advanced Micro Devices by 4.6%, and Broadcom by 3.3%. Investors are eagerly watching to see if this momentum can be sustained as the earnings season progresses.

What happens next will be critical as other tech firms report their earnings. The market’s focus will remain on Nvidia’s ability to maintain this growth and if it can help quell fears of an impending AI bubble. Stay tuned for further updates on this developing story.