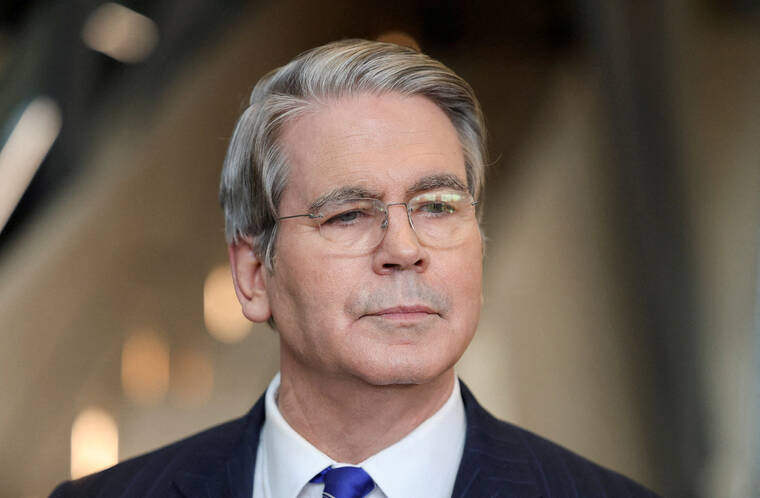

Frank Demaria, an insider at NewtekOne, Inc. (NASDAQ: NEWT), purchased 1,556 shares of the company on January 14, 2024. The shares were bought at an average price of $13.91 each, bringing the total investment to approximately $21,643.96. Following this transaction, Demaria holds 35,220 shares of NewtekOne, valued at around $489,910.20. This acquisition marks a 4.62% increase in his holdings.

The purchase was disclosed in a filing with the Securities and Exchange Commission, confirming the transaction’s details and reflecting Demaria’s confidence in the company’s future.

Current Market Performance

On January 19, 2024, shares of NewtekOne declined by 0.3%, closing at $14.55. During the trading session, 105,324 shares changed hands, significantly lower than the average volume of 331,449 shares. The company currently maintains a market capitalization of $420.35 million and has a price-to-earnings ratio of 6.53. Its quick and current ratios stand at 0.67 each, while the debt-to-equity ratio sits at 5.69. Over the past year, NewtekOne’s stock has fluctuated between a low of $9.12 and a high of $14.77.

In its latest earnings report, released on October 29, 2023, NewtekOne reported earnings per share (EPS) of $0.67, surpassing analysts’ expectations of $0.63. The company generated revenue of $74.94 million, falling short of predictions of $78.31 million. NewtekOne’s net margin was 15.59%, with a return on equity of 19.93%. Analysts forecast an EPS of 1.93 for the current fiscal year.

Analyst Ratings and Institutional Holdings

A number of analysts have recently reviewed NewtekOne’s stock. Keefe, Bruyette & Woods maintained a “market perform” rating while raising the price target from $12.00 to $13.00. Wall Street Zen upgraded the stock from “sell” to “hold” in a note issued on December 27, 2023. Weiss Ratings also reiterated a “hold (c)” rating, while Piper Sandler adjusted their price target from $12.50 to $13.00 with a “neutral” rating.

Currently, one research analyst has rated NewtekOne with a “strong buy” and four have assigned it a “hold” rating. According to MarketBeat, the stock has a consensus rating of “hold” with a target price of $14.50.

In terms of institutional investment, several hedge funds have modified their stakes in NewtekOne. Trust Co. of Vermont initiated a position in the second quarter, valued at approximately $29,000. Advisory Services Network LLC followed suit in the third quarter with a stake worth around $46,000. IFP Advisors Inc. expanded its holdings by 74.9% during the second quarter, owning 6,776 shares valued at $77,000 after acquiring an additional 2,901 shares. CWM LLC significantly increased its stake by 728.7%, now owning 8,610 shares worth $97,000 after purchasing an additional 7,571 shares. Overall, hedge funds and institutional investors hold 38.35% of NewtekOne’s stock.

NewtekOne, Inc. operates as a business development company, providing financial and business services primarily to small and medium-sized enterprises across the United States. Its offerings include a range of lending solutions tailored to meet the diverse needs of its clientele, including Small Business Administration (SBA) 7(a) loans, equipment financing, lines of credit, and commercial real estate financing.