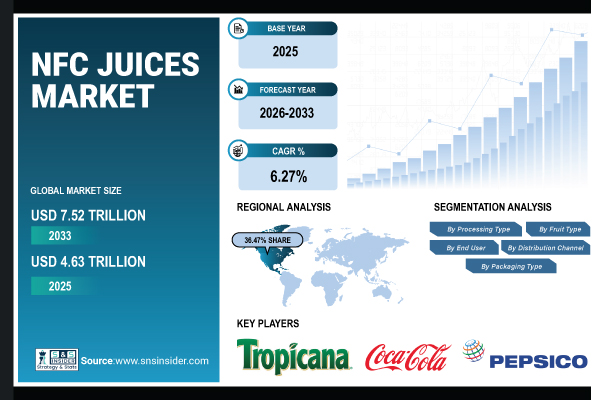

The NFC (Not From Concentrate) juices market is expected to experience significant growth, projected to reach a remarkable USD 7.52 trillion by 2033, up from USD 4.63 trillion in 2025. This growth represents a compound annual growth rate (CAGR) of 6.27% during the forecast period from 2026 to 2033. According to a report by SNS Insider, the increase in NFC juice consumption is attributed to rising retail penetration, an expanding range of cold-pressed options, and a growing consumer preference for natural, minimally processed beverages.

The market in the United States is projected to grow from USD 1.33 trillion in 2025 to USD 2.01 trillion by 2033, reflecting a CAGR of 5.37%. This growth is driven by strong household acceptance, increasing foodservice demand, and the rise of e-commerce, along with a shift towards premium and functional fruit juices that meet consumers’ health-conscious needs.

Market Drivers and Consumer Trends

A key factor fueling the expansion of the NFC juices market is the growing consumer preference for products that are natural and minimally processed. Juices that preserve the integrity, fresh flavor, and nutritional value of the fruit without added sugars or concentrates are gaining popularity as health awareness increases. The demand for cold-pressed and premium NFC juice products aligns with the trend towards cleaner labels and authentic fruit characteristics, enhancing shopping behaviors in households, restaurants, and retail establishments.

Significant players in the NFC juices market include industry leaders such as Tropicana Products Inc., The Coca-Cola Company, and PepsiCo, Inc.. These companies are actively responding to the changing consumer landscape, introducing products that cater to the demand for healthful hydration options.

Market Segmentation and Growth Areas

The NFC juices market is segmented by fruit type, processing method, packaging type, distribution channel, and end-user. In terms of fruit type, orange juice commanded the largest market share of 27.58% in 2025, owing to its widespread consumer preference and versatility across various channels. Berries are anticipated to witness the fastest CAGR of 8.14% during the forecast period, driven by the increasing popularity of exotic and health-focused beverages.

Processing methods reveal that pasteurized juices held a dominant market share of 65.37% in 2025 due to their extended shelf life and broad distribution. In contrast, the unpasteurized or cold-pressed segment is projected to experience the fastest growth, with a CAGR of 7.85%, as consumers increasingly seek nutrient-rich beverages.

The packaging type most favored by consumers is bottles, which accounted for 41.26% of the market share in 2025. However, pouches are anticipated to grow rapidly, with a CAGR of 8.02%, reflecting trends towards portability and eco-friendly packaging.

Distribution channels also play a critical role in market dynamics. Supermarkets and hypermarkets held the largest share of 38.14% in 2025, while online retail and e-commerce are expected to expand at a remarkable CAGR of 9.14% through 2033, driven by consumer preferences for convenience and home delivery options.

Among end-users, households dominated with a significant share of 54.36% in 2025, indicating a consistent demand for healthy, natural beverages. The foodservice sector is projected to register a CAGR of 7.92%, influenced by the increasing inclusion of fresh juice options in cafes and restaurants.

Regional analysis shows that North America led the NFC juices market with a share of 36.47% in 2025, propelled by high health awareness and a strong demand for natural products. The Asia Pacific region is expected to grow at an impressive CAGR of 7.84% from 2026 to 2033, driven by rising health consciousness and the demand for functional beverages in countries such as China, India, Japan, and South Korea.

Recent developments in the market reflect the responsiveness of major players to consumer needs. In August 2025, Tropicana Products Inc. launched “Tropicana Essentials,” a new line of NFC juices that combines orange, apple, and pear juices fortified with vitamins, targeting busy families. In February 2025, The Coca-Cola Company introduced “Simply Pop Prebiotic Soda,” a functional beverage designed for health-conscious consumers, further solidifying its foothold in the juice-infused drinks category.

As the NFC juices market continues to evolve, stakeholders are encouraged to monitor trends in consumer behavior, processing efficiencies, and sustainability practices to remain competitive in this dynamic landscape.