Nvidia’s CEO, Jensen Huang, has addressed recent discussions surrounding potential taxes on billionaires, stating that such measures are “perfectly fine.” This statement comes amid renewed conversations about wealth taxation, particularly in California, where the political climate appears more receptive to these ideas than in previous years.

Historically, efforts to implement taxes targeting the ultra-wealthy have struggled to gain traction in the United States. However, with growing public concern over wealth inequality, the situation may be changing. California’s political leaders have signaled a willingness to consider reforms aimed at ensuring that the wealthiest individuals contribute a fairer share to the state’s economy.

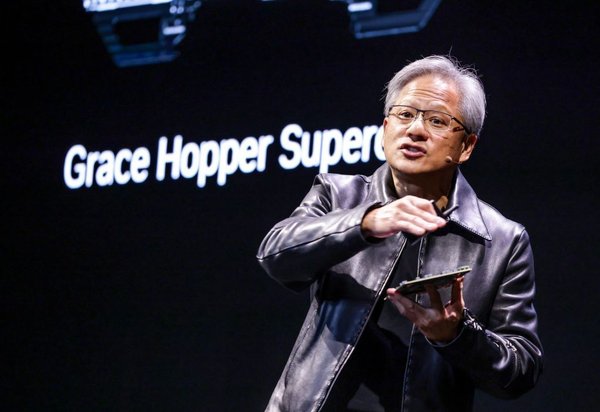

During a recent interview, Huang expressed his views on the matter and emphasized that he does not see a wealth tax as a negative development. He remarked that while some billionaires may view such taxes unfavorably, he believes they can play an important role in addressing social challenges. Huang’s comments suggest that he supports the idea of using tax revenue to fund public services and infrastructure.

California’s proposed tax reforms could include a new wealth tax that targets individuals with a net worth exceeding $1 billion. If passed, this legislation could introduce significant changes to the financial landscape for many of the state’s wealthiest residents. The idea has already sparked debate among lawmakers and economists, with some arguing that it could drive high-income earners out of the state.

Huang’s endorsement of the wealth tax reflects a broader trend among some tech leaders who recognize the importance of addressing wealth disparity. As the technology sector continues to thrive, the gap between the wealthy and the rest of the population has raised eyebrows. Analysts suggest that industry figures like Huang could play a crucial role in shaping public opinion on such matters.

The 2023 tax proposals are part of California’s ongoing efforts to tackle income inequality and provide better support for public services, which have faced budget constraints in recent years. As discussions evolve, it remains to be seen how these proposals will be received by the public and whether they will lead to tangible changes in the tax code.

In summary, Jensen Huang‘s comments highlight a growing acceptance of wealth taxes among some billionaires. As California continues to explore reforms, the impact of these discussions on the state’s economy and social fabric could be significant. The coming months will be crucial as stakeholders engage in debates over the future of tax policy and wealth distribution in America.