R Squared Ltd has significantly increased its stake in Intuitive Surgical, Inc. (NASDAQ: ISRG) by a remarkable 267.5% during the second quarter of 2023. According to a recent filing with the Securities and Exchange Commission (SEC), R Squared Ltd acquired an additional 2,033 shares, bringing its total holdings to 2,793 shares. This investment now represents 0.8% of R Squared Ltd’s portfolio, making it the firm’s 14th largest holding, valued at approximately $1.52 million.

The move by R Squared Ltd comes as part of a broader trend among institutional investors. Several other firms have also adjusted their positions in Intuitive Surgical recently. For instance, Vanguard Group Inc. raised its holdings by 1.4% in the first quarter, now owning 32,665,531 shares worth around $16.18 billion after acquiring an additional 453,335 shares. Similarly, Invesco Ltd. increased its stake by 1.7%, bringing its total to 4,219,974 shares, valued at approximately $2.09 billion.

Other notable changes include Northern Trust Corp’s 0.3% increase, now holding 3,631,281 shares, and Wellington Management Group LLP’s substantial 15.0% increase, resulting in 3,499,052 shares valued at about $1.73 billion. Overall, institutional investors and hedge funds collectively own 83.64% of Intuitive Surgical’s stock.

Analysts Offer Insights on Intuitive Surgical

Wall Street analysts have been actively evaluating Intuitive Surgical’s performance. Jefferies Financial Group recently raised its price target for the company’s shares from $550.00 to $560.00, maintaining a “hold” rating. In contrast, Evercore ISI cut its price target from $535.00 to $450.00 while assigning an “in-line” rating. UBS Group set a price target of $600.00 with a “neutral” rating, while HSBC increased its target from $595.00 to $644.00, giving the stock a “buy” rating.

The consensus rating among analysts is currently a “Moderate Buy,” with an average price target set at $604.50. Eighteen analysts have rated the stock as a Buy, while eight have given it a Hold rating, and one analyst has issued a Sell rating.

Insider Trading Activity

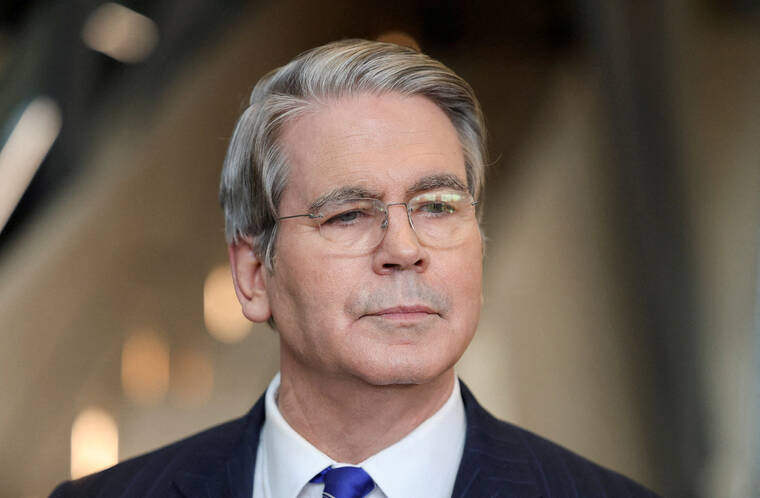

In related news, insider trading has also been notable. Gary S. Guthart, the CEO of Intuitive Surgical, sold 29,360 shares on August 29, 2023, at an average price of $472.49, totaling approximately $13.87 million. Following this transaction, Guthart holds 19,827 shares valued at around $9.37 million, marking a significant 59.69% reduction in his position.

Another insider, Director Amy L. Ladd, sold 335 shares on September 4, 2023, at an average price of $440.69, amounting to about $147,631.15. This sale reduced her holdings by 31.19%. In total, insiders have sold 40,724 shares worth approximately $19.5 million over the last 90 days, while corporate insiders now own 0.70% of the company’s stock.

Stock Performance and Financial Overview

As of October 20, 2023, Intuitive Surgical’s stock opened at $551.30. The company’s fifty-day moving average stands at $456.77, and the two-hundred day moving average is at $496.40. Intuitive Surgical boasts a market capitalization of $197.63 billion, a P/E ratio of 72.92, and a price-to-earnings-growth ratio of 5.53.

The stock has experienced significant volatility over the past year, with a fifty-two week low of $425.00 and a high of $616.00. The company recently reported its quarterly earnings on October 21, 2023, revealing earnings per share of $2.40, surpassing analysts’ expectations of $1.99 by $0.41. Revenue for the quarter reached $2.51 billion, exceeding predictions of $2.41 billion and representing a year-over-year increase of 22.9%.

Analysts anticipate that Intuitive Surgical will post earnings per share of $6.43 for the current year. The company is recognized for its innovations in minimally invasive surgical technologies, notably the da Vinci Surgical System and the Ion endoluminal system, which enhance patient care and diagnostics.

For more insights on institutional holdings and trading activity related to Intuitive Surgical, interested parties can visit financial news platforms for detailed updates.