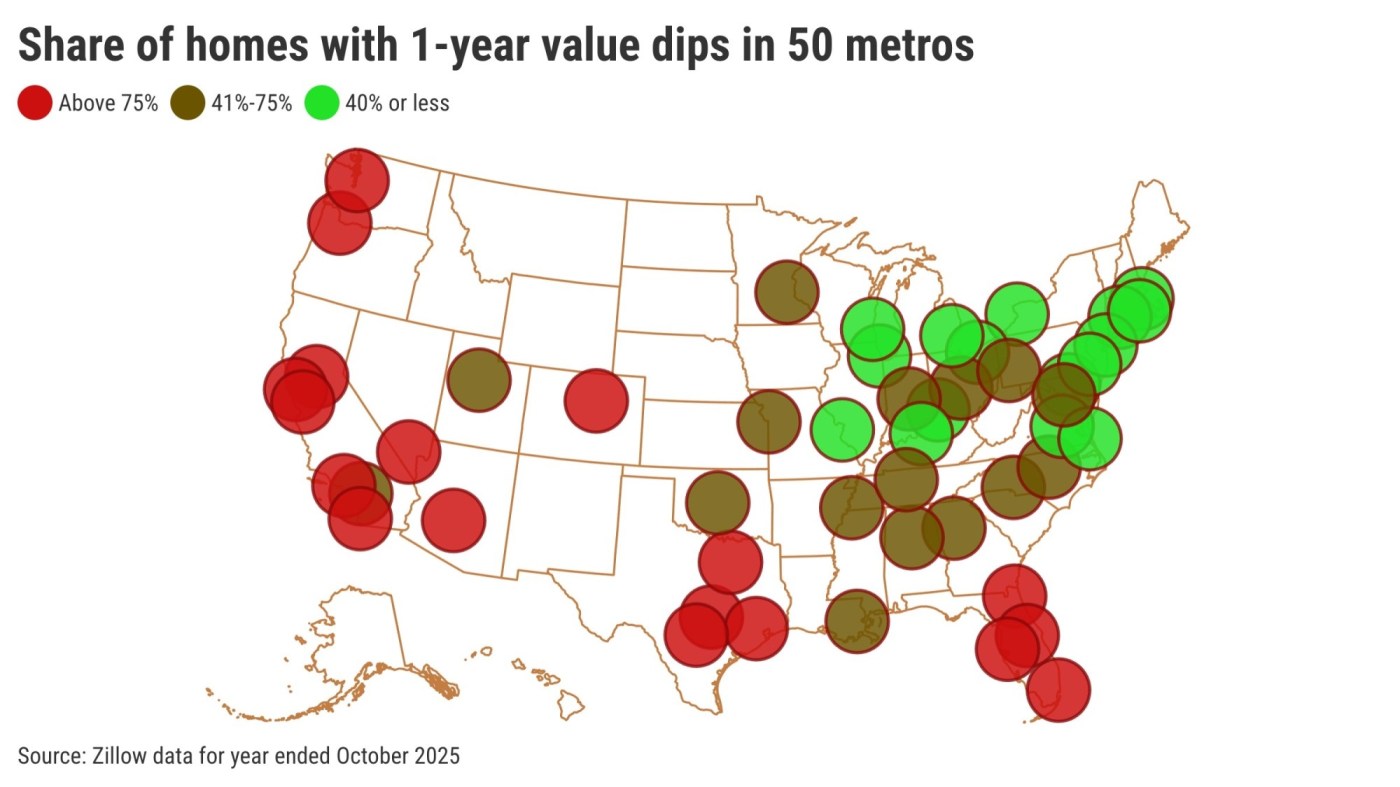

The real estate market in Southern California is experiencing a notable downturn, with home values declining for approximately 75% of properties in the region over the past year. According to a report by Zillow, which analyzed housing prices in 50 major metropolitan areas, this trend reflects a broader national pattern, albeit with varying degrees of severity.

The most significant decrease was evident in the Los Angeles and Orange County area, where 79% of homes saw a reduction in value. This region ranks 14th among the 50 metropolitan areas studied. The average decline from recent peak valuations in Los Angeles and Orange County is 7.5%, placing it at 29th nationally in terms of home value drops.

Regional Variations in Home Value Drops

In San Diego County, 78% of homes experienced a decline, ranking 17th nationally. The average drop in this area was slightly steeper at 8.2%, putting it at 22nd in the overall rankings. Homeowners in San Diego also tend to hold onto their properties longer, with a median ownership period of 11 years, resulting in an 88% increase from their original purchase price.

The Inland Empire reported that 74% of homes have lost value, ranking 19th nationally, with an average decline of 6.5% from peak values. The median ownership period here is approximately 10 years, reflecting an 80% gain above purchase prices.

Despite these declines, the situation is not uniformly positive for potential buyers. In Los Angeles and Orange County, homeowners are reluctant to sell, with a median ownership duration of 12 years, the second-longest in the country. Even with the recent value drops, the median home remains priced 85% above its last purchase price, which ranks as the sixth-highest in the nation.

Comparison with Northern California Markets

Price reductions are more pronounced in Northern California. For instance, in Sacramento, 88% of homes lost value, making it 3rd nationally, with an average decline of 8.7% from peak prices. San Francisco houses also showed considerable drops, with 83% experiencing declines, averaging 14.8% from their peak values, ranking 3rd in the nation.

San Jose is not far behind, with 78% of homes losing value and an average decline of 10.3%. The median ownership period in San Jose is 13 years, with an impressive 97% gain above original purchase prices.

On a national scale, home values have decreased for 53% of properties, with an average decline of 9.7%. The median ownership duration across the country stands at 9 years, reflecting a 67% gain above purchase prices.

The data reflects a complex landscape for homebuyers, with many still facing barriers despite lower prices. Jonathan Lansner, business columnist for the Southern California News Group, emphasizes that while the market shows signs of adjustment, the underlying dynamics of ownership patterns and price elevations continue to challenge prospective buyers.

For those considering entering the market, understanding these trends is crucial. The fluctuating values and long ownership durations indicate that, while opportunities may arise, significant hurdles remain in the quest for affordable housing in Southern California.