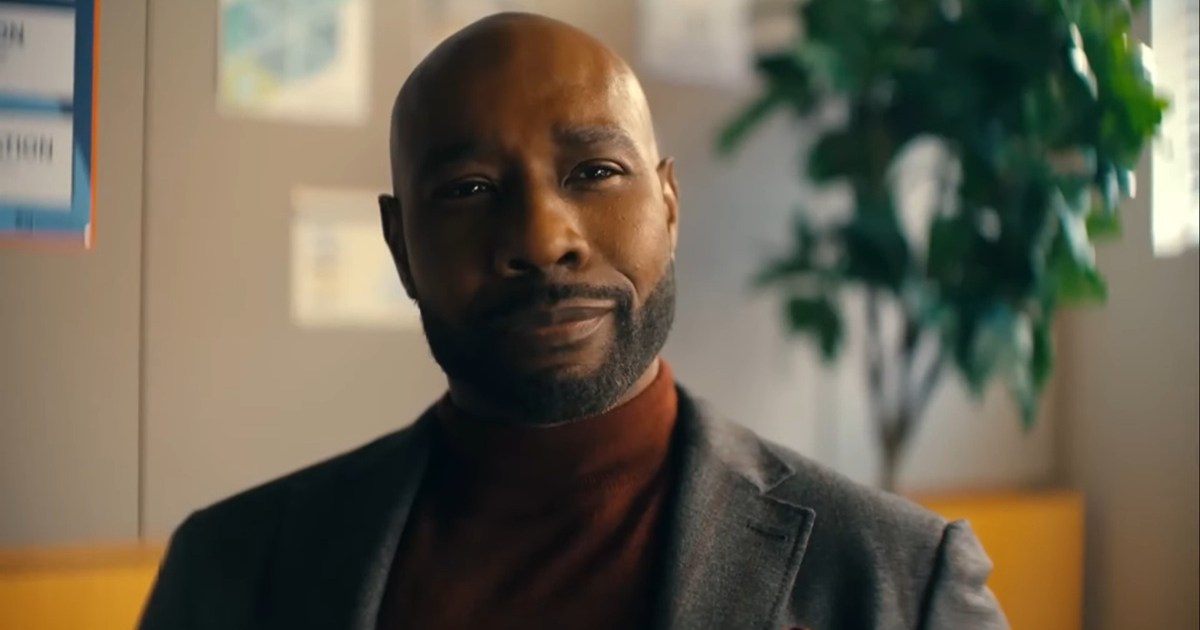

Jared Esguerra has established himself as a pivotal figure in the convergence of blockchain technology and finance over the past decade. As both an investor and innovator, he has successfully navigated the complexities of the fintech landscape, championing advancements that have reshaped the industry. His journey is not just a story of personal achievement; it serves as a blueprint for those looking to understand the potential of emerging technologies in financial services.

A Visionary’s Journey Begins

Esguerra’s foray into fintech started long before the term “blockchain” gained mainstream recognition. Initially immersed in traditional finance, he soon recognized the limitations of established banking systems, including outdated infrastructure and regulatory hurdles. These experiences ignited a desire to not just improve but fundamentally transform the financial landscape.

His pivotal moment arrived with the advent of blockchain technology. While many viewed Bitcoin merely as a speculative investment, Esguerra recognized its transformative potential. He articulated this vision succinctly, stating, “What excited me wasn’t just digital currency; it was the promise of a new kind of infrastructure — programmable money, programmable trust.” This perspective set the stage for his future endeavors, where he sought to merge traditional finance with decentralized innovations.

Bridging Two Worlds

As blockchain technology matured, Esguerra positioned himself as a crucial link between conventional finance and the burgeoning world of decentralized finance (DeFi). He focused on identifying and investing in projects that addressed real-world challenges rather than those merely riding the hype wave. His early investments included blockchain-based lending platforms and digital payment solutions designed to streamline cross-border transactions. While these projects initially appeared niche, they have since become integral to the decentralized financial ecosystem, facilitating billions in transactions.

Esguerra’s insights into the convergence of finance and technology have been key to his success. He identified trends like stablecoins and decentralized identity verification long before they gained widespread acceptance. His strategic focus on the infrastructure underpinning fintech innovations has allowed him to stay ahead of the curve.

Over the last ten years, Esguerra has played a significant role in the evolution of fintech. He promoted digital payment platforms that empowered small businesses in emerging markets, enabling them to transact globally with reduced fees. His commitment to DeFi reflects a belief in its inevitability, as he understood that the traditional financial system’s intermediaries were vulnerable to disruption.

“Every layer of finance that charges a fee for access or validation is an opportunity for decentralized innovation,” Esguerra remarked, highlighting his forward-thinking approach.

A Disciplined Investor

What distinguishes Esguerra is not just his technical expertise but also his disciplined mindset. He combines patience and long-term strategic thinking, which are increasingly rare in an industry known for its rapid fluctuations. Esguerra emphasizes the importance of foresight, noting his ability to identify “inflection points” where technology transitions from experimentation to widespread adoption.

His approach to investing is meticulous. Esguerra carefully examines macroeconomic conditions, token dynamics, governance models, and long-term adoption metrics. This balanced decision-making process is informed by both quantitative data and qualitative insights, allowing him to navigate the often tumultuous waters of fintech with confidence.

Esguerra acknowledges the challenges inherent in the blockchain and fintech sectors, including volatility and regulatory uncertainties. Instead of shying away from these issues, he confronts them directly. He collaborates with compliance experts to develop frameworks for decentralized finance that prioritize responsible innovation while ensuring consumer protection and financial stability.

Looking to the Future

As Esguerra contemplates the future, he remains driven by a sense of curiosity and purpose. He envisions the next decade as one defined by the integration of artificial intelligence, blockchain, and data analytics into a cohesive fintech ecosystem. Concepts such as AI-driven risk assessment, blockchain-secured transactions, and decentralized digital identity are shifting from theoretical ideas to practical applications that will redefine the financial landscape.

Esguerra’s investments are already reflecting this convergence, as he supports initiatives that leverage AI for analyzing blockchain data and developing robust frameworks for future technologies. His core belief that innovation should empower individuals drives his vision for a financial system that is not only efficient but also fair and inclusive.

In essence, Esguerra’s journey illustrates that success in fintech is not about chasing fleeting trends but about anticipating transformative changes and building the necessary systems to support them. As blockchain technology continues to evolve, his influence and contributions are likely to expand, shaping the future of finance one innovative step at a time. Esguerra’s commitment to a borderless, inclusive, and transparent financial landscape remains unwavering, reflecting his long-term vision for the industry.