Investors are closely examining two consumer discretionary companies, **Ceconomy AG** and **HempAmericana**, to determine which offers stronger potential for growth and returns. This article compares the firms on several key metrics, including dividend strength, valuation, institutional ownership, earnings, profitability, and analyst recommendations.

Volatility and Risk Assessment

**Ceconomy** has a beta of **1.44**, indicating that its stock price experiences **44%** more volatility than the **S&P 500**. This higher volatility suggests that Ceconomy may be subject to larger price swings, which can impact investment risk. Conversely, **HempAmericana** presents a contrasting picture with a beta of **-0.2**, making it **120%** less volatile than the benchmark index. This lower volatility may appeal to more risk-averse investors.

Earnings and Valuation Comparison

A comparison of the revenue and earnings per share (EPS) reveals that while **HempAmericana** has lower revenue figures, it boasts higher earnings than **Ceconomy**. This dynamic raises interesting questions about the sustainability of profitability in both companies. Analysts from **MarketBeat** have provided ratings that indicate a more favorable outlook for HempAmericana, primarily due to its potential for upside growth.

Profitability metrics further illustrate the differences between the two companies. A detailed examination of net margins, return on equity, and return on assets shows that **Ceconomy** outperforms **HempAmericana** in **7 out of 8** categories assessed, highlighting its stronger financial health despite the comparative earnings advantage of HempAmericana.

**Ceconomy AG**, headquartered in **Düsseldorf, Germany**, operates in the consumer electronics retail sector. With stores branded as **MediaMarkt** and **Saturn**, it provides professional assistance in electronic device installation and troubleshooting across various European countries, including **Germany**, **Austria**, **Switzerland**, and **Hungary**.

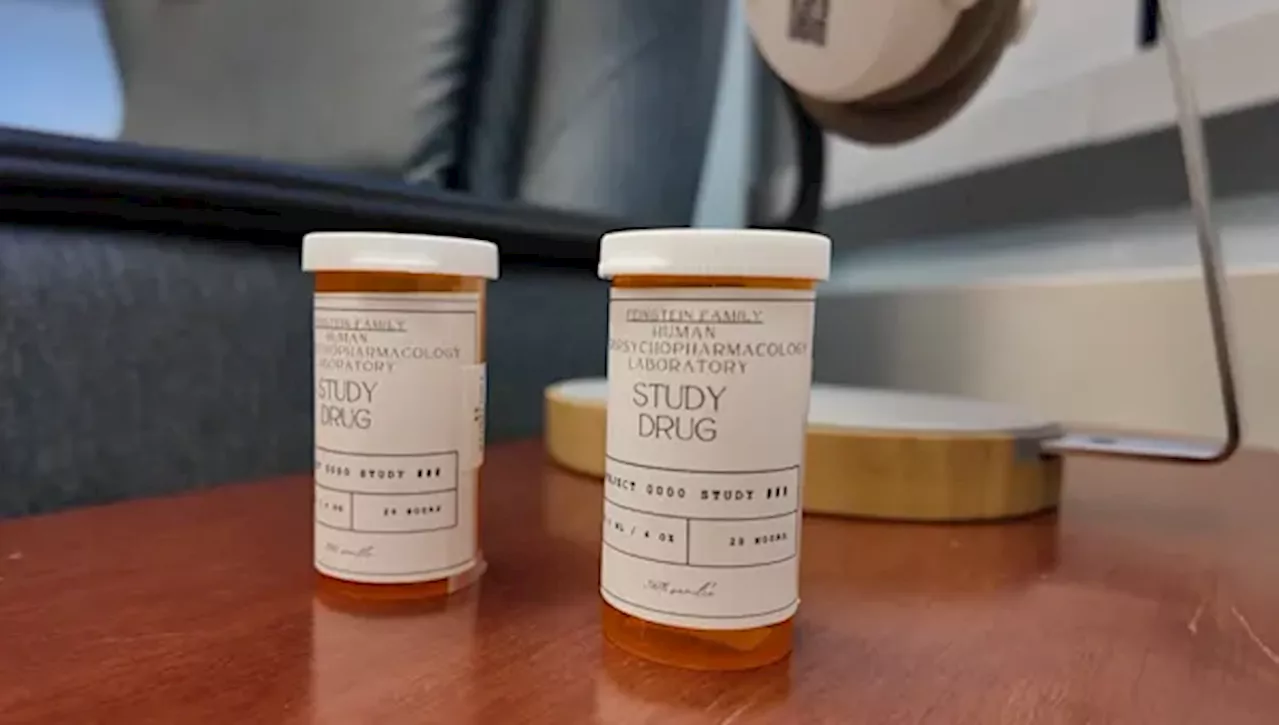

In contrast, **HempAmericana**, based in **New York, New York**, specializes in products derived from industrial hemp. The company markets a range of offerings, including hemp-based concrete, bags, seeds for consumption, clothing, and rolling paper products. Established in **2014**, it aims to capitalize on the growing demand for sustainable and eco-friendly materials.

As investors weigh their options, the contrasting profiles of **Ceconomy** and **HempAmericana** illustrate the diverse landscape of consumer discretionary companies. Each firm presents unique opportunities and risks, necessitating careful consideration based on individual investment strategies and market conditions.