Tensions between the United States and Iran have once again captured attention, leading to fluctuations in oil prices. Following remarks from former President Donald Trump on March 1, 2024, there was initial relief in the market. Trump indicated that violence in Iran was diminishing and that there were no imminent plans for executions of protestors. This comment led to a significant drop in oil prices, as he had previously threatened “strong actions” should the Iranian government continue its crackdown on dissent.

However, events took a turn late yesterday when Fox News reported the mobilization of US military assets—air, land, and sea—heading towards the Middle East. The report suggests that this military transit will take approximately one week to complete. Although a week may seem like ample time for the situation to stabilize, the unpredictability of actions from the Trump administration raises concerns about potential escalation during this period.

Israeli Prime Minister Benjamin Netanyahu reached out to Trump on Wednesday, urging restraint to allow Israel additional time to prepare for any Iranian retaliation. While such diplomatic exchanges may appear routine, they can influence market sentiment. As a result, oil markets may begin to reassess geopolitical risk premiums, particularly after the recent sharp selloff.

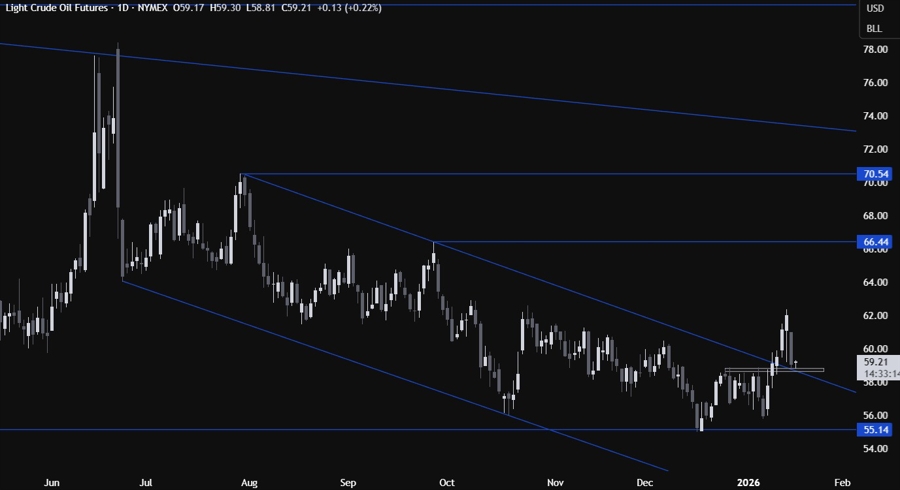

In the wake of these developments, the price of WTI oil futures has retraced to a critical support zone around $58.80. Buyers have emerged at this level, establishing positions with set risk thresholds below support, anticipating a potential rally towards $66.00. Conversely, sellers are eyeing a breakdown below this support, which could signal a decline back to the $55.00 range.

Market analysts note that the price is currently consolidating near support, reflecting uncertainty about the next moves of both buyers and sellers. Technically, the market appears to be waiting for a breakout in either direction, with traders keenly observing the evolving geopolitical landscape.

As the weekend approaches, there may be increased hedging activity in anticipation of further developments. The situation remains fluid, and the interplay between US and Iranian actions will be pivotal in determining the trajectory of oil prices in the coming days.