Viking Fund Management LLC has increased its investment in AT&T Inc. (NYSE: T) by 9.8% during the third quarter of 2023. According to a recent disclosure with the Securities and Exchange Commission, Viking now holds 425,000 shares of the technology company after acquiring an additional 38,000 shares. AT&T now represents approximately 1.5% of Viking’s total assets, making it the firm’s 19th largest holding. The value of Viking’s stake in AT&T stood at about $12 million at the end of the reporting period.

A number of other institutional investors have also adjusted their positions in AT&T. For instance, Vanguard Group Inc. increased its holdings by 1.6% in the second quarter, now owning 661,355,210 shares valued at approximately $19.14 billion. Similarly, State Street Corp raised its AT&T shares by 2.4%, bringing its total to 321,070,509 shares worth around $9.29 billion. Other notable investors include Kingstone Capital Partners Texas LLC, which acquired a new stake valued at about $5.27 billion, and Norges Bank, which made a new investment worth approximately $2.23 billion.

Analysts Adjust Price Targets for AT&T

Several analysts have recently revised their price targets for AT&T. Morgan Stanley reduced its target from $32.00 to $30.00 while maintaining an “overweight” rating. In a similar move, Barclays lowered its target from $30.00 to $28.00, assigning an “equal weight” rating. Meanwhile, the Goldman Sachs Group adjusted its target from $33.00 to $29.00, designating the stock as a “buy.”

Overall, analysts hold a consensus rating of “Moderate Buy” for AT&T, with a price target averaging $30.36. Among those providing ratings, one analyst designated the stock as a Strong Buy, while sixteen gave it a Buy rating and nine issued a Hold rating.

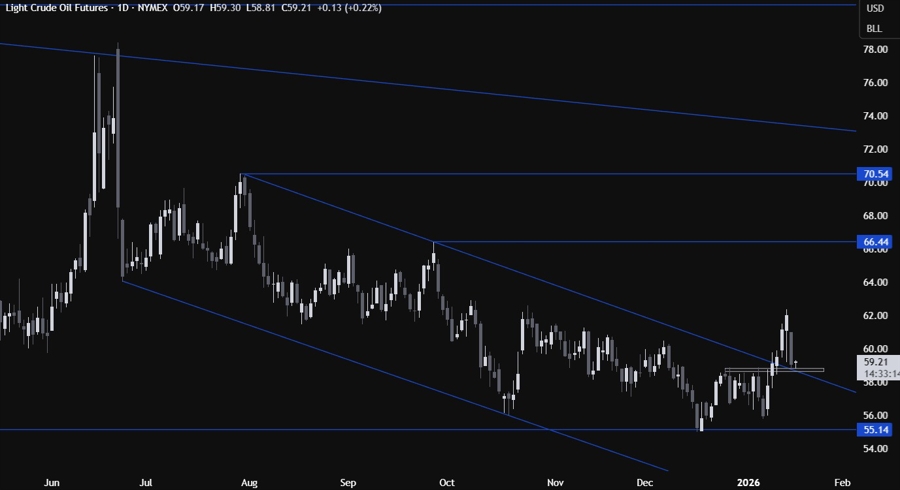

Current Stock Performance and Upcoming Dividend

Shares of AT&T opened at $24.11 on Friday, with the stock experiencing a decline of 0.6%. Its market capitalization is approximately $170.95 billion. The company has a P/E ratio of 7.83 and a PEG ratio of 1.41. AT&T’s stock has seen a one-year low of $21.38 and a one-year high of $29.79.

The company’s quarterly earnings report, released on October 22, 2023, revealed earnings per share (EPS) of $0.54, aligning with analysts’ expectations. AT&T’s revenue for the quarter was $30.71 billion, slightly below projections of $30.85 billion, but still representing a 1.7% increase year-over-year.

AT&T also announced a quarterly dividend of $0.2775 per share, payable on February 2, 2024, to shareholders of record on January 12, 2024. This translates to an annualized dividend of $1.11 and a yield of 4.6%. AT&T’s dividend payout ratio stands at 36.04%.

As a global telecommunications leader, AT&T continues to deliver a wide range of communications and digital entertainment services. Its operations include wireless services, broadband, and network infrastructure, catering to both consumer and business needs. The firm remains a significant player in the market, with institutional investors collectively holding 57.10% of its shares.