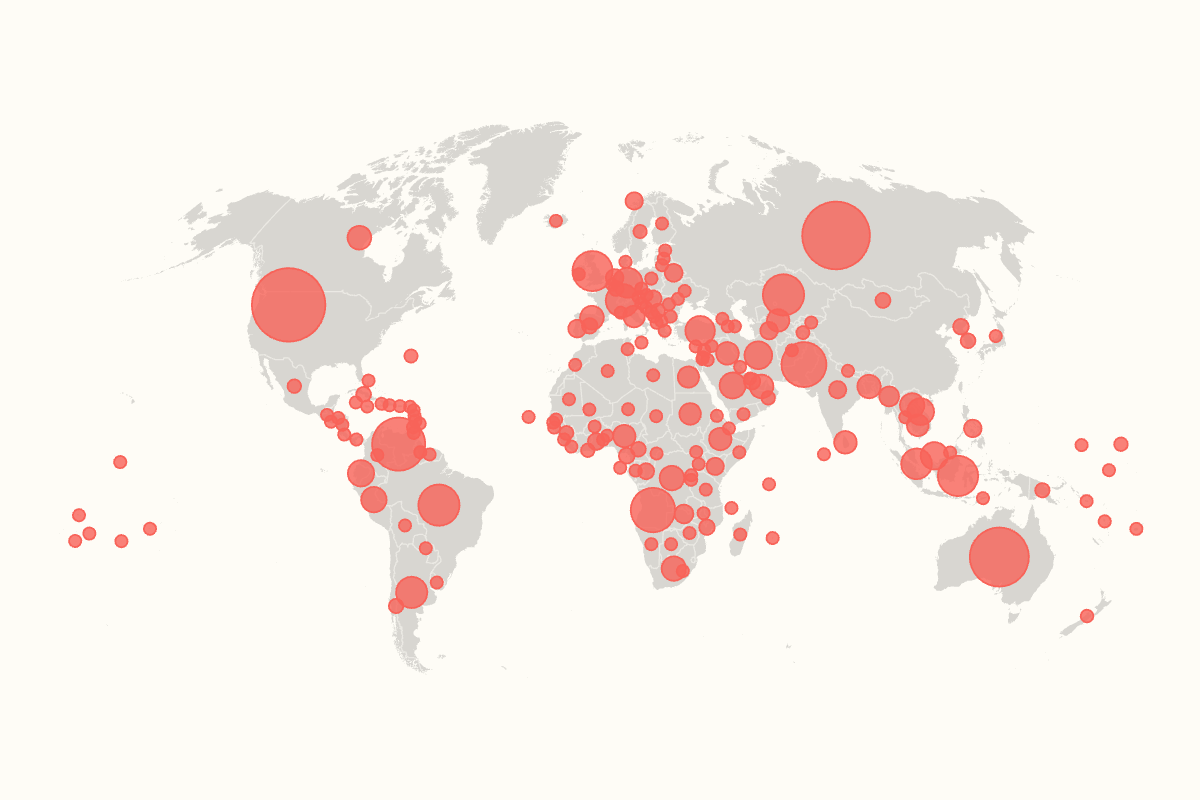

UPDATE: A groundbreaking report from Virginia-based research institute AidData reveals that China’s global lending portfolio has surged to $2.1 trillion, dramatically reshaping international financial dynamics. This urgent finding, based on an extensive three-year study tracking 30,000 projects across 217 countries, highlights China’s significant role as the world’s largest creditor, outpacing its rivals in diplomatic influence and strategic resource access.

The report indicates that high- and upper-middle-income nations represent a staggering 76 percent of these loans, challenging long-held beliefs that China’s lending efforts primarily target developing countries. Among the top recipients, the United States stands at the forefront, with $202 billion in Chinese state-linked loans funding 2,500 projects nationwide. Following closely, Russia received $172 billion, and Australia accounted for $130 billion.

As China’s lending practices come under scrutiny, critics label these financial arrangements as “debt-trap diplomacy,” suggesting they lead to increased influence over critical infrastructure in borrowing nations. However, Chinese officials refute this narrative, asserting that their overseas lending is based on mutually beneficial and market-driven principles.

Brad Parks, executive director of AidData, stated, “This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.” The report underscores the growing complexity of international finance as traditional lenders like the U.S., Germany, and Japan reassess their lending strategies to counter China’s expanding influence.

The report indicates that Venezuela and Pakistan rank fourth and fifth, respectively, with loans of $105.7 billion and $75.6 billion. Interestingly, even the United Kingdom, the world’s sixth-largest economy, appears on the list, ranking tenth with substantial Chinese lending.

Given that China does not disclose official data on its foreign lending, AidData’s findings are based on meticulous analysis of loan contracts, grant records, and host-country documentation, marking a vital contribution to understanding global debt dynamics.

As the implications of this report unfold, experts warn that China’s role as a “new global pace-setter” may force other nations to adapt quickly to avoid being outmaneuvered. The authors of the study emphasize that traditional lending powers must recalibrate their strategies to remain competitive in an evolving landscape of international aid and credit.

This developing story is sure to influence global economic discussions and international relations. As further insights emerge, the world will be watching closely to see how countries respond to China’s expanding financial reach.