URGENT UPDATE: As of December 22, 2025, forex markets are experiencing significant thinness in liquidity due to the holiday season, impacting trading volumes and price stability. With many wholesale market participants already closed for the holidays, traders are advised to exercise caution as prices may swing unpredictably.

Early indications show minimal changes from late Friday’s trading. This situation is likely to persist until the market fully reopens on January 5, 2026. Retail traders should be particularly vigilant, as the lack of other time frame (OTF) participants will create a choppy trading environment.

Market experts warn that the current liquidity crunch could lead to heightened volatility.

“If you plan to trade during this period, it’s crucial to manage your risk effectively,”

stated a forex analyst from InvestingLive. With a dwindling economic calendar, significant events are few and far between, adding to the uncertainty.

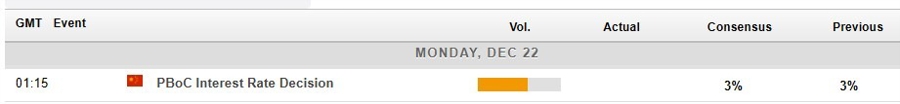

In China, the People’s Bank of China (PBOC) has kept its Loan Prime Rates (LPRs) steady, marking six months without adjustments. The one-year LPR, a key benchmark for most lending, remains unchanged, while the five-year rate that guides mortgage pricing also holds firm. The last reduction of 10 basis points occurred in May 2025.

With China’s main policy rate currently at 1.4% for the seven-day reverse repo rate, market analysts are closely monitoring these figures as they influence interbank lending rates and overall market dynamics. The PBOC utilizes these rates to manage liquidity in the banking system, crucial during this thin trading period.

As traders navigate this quiet market landscape, the importance of strategic decision-making cannot be overstated. With many platforms reducing coverage until early January, traders are encouraged to conserve capital and prepare for a more robust trading environment in the new year.

Stay tuned for real-time updates as the situation develops.