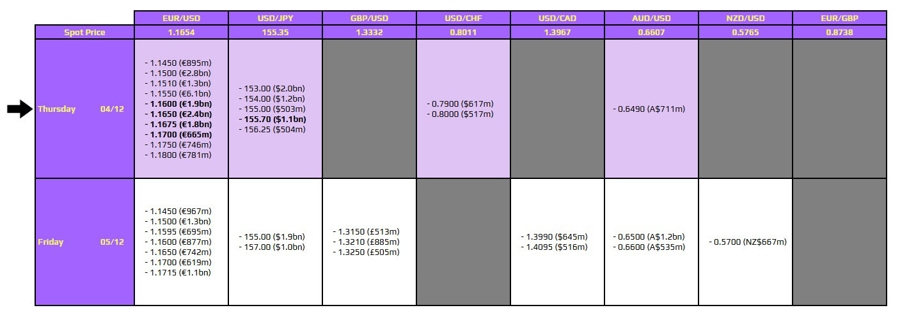

UPDATE: Major FX option expiries are set for today, 4 December, at 10 AM New York time, impacting trading dynamics for currencies, particularly EUR/USD and USD/JPY. The most significant expiries for EUR/USD are layered from 1.1600 to 1.1700, with a concentration around 1.1650. This development is expected to create a tighter trading range as a weaker dollar supports the pair this week.

The presence of these sizable options could restrict price movements throughout today’s session, especially until the expiries roll off later in the day. Traders should remain vigilant as these levels will likely dictate market actions.

For USD/JPY, an important expiry sits at 155.70, closely aligned with the 100-hour moving average of 155.67. This positioning may inhibit any upward movements in the session, as the pair appears to be under pressure following a softer dollar and heightened expectations for a potential interest rate hike by the Bank of Japan (BOJ) this month.

Traders are urged to monitor these developments closely, as they can influence market sentiment and positioning significantly. As the clock ticks down to the expiry, volatility may increase, offering both risks and opportunities for market participants.

Stay informed by following updates from reliable sources and join the conversation on platforms like investingLive for the latest insights and analysis. Don’t miss out on navigating these critical market shifts—this is a pivotal moment for forex traders!