UPDATE: Just minutes ago, former President Donald Trump raised alarms regarding the recently announced $82.7 billion merger between Netflix and Warner Bros. Discovery, suggesting it “could be a problem.” Speaking at an event at the John F Kennedy Center in Washington D.C., Trump expressed concerns about Netflix’s already substantial market share, predicting it would “go up by a lot” if the merger proceeds.

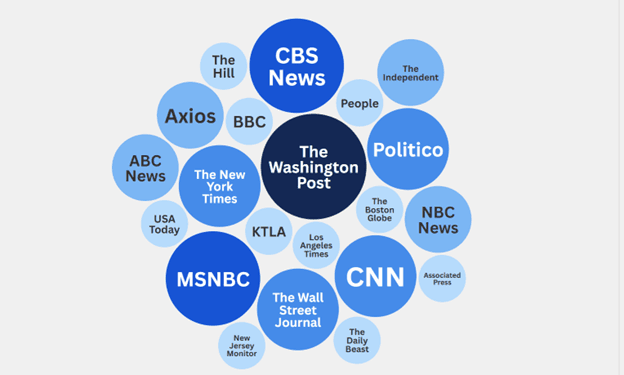

This warning comes as the streaming landscape is rapidly evolving, with Netflix and HBO Max controlling a combined 34% of the US streaming market, which may exceed the US Department of Justice’s antitrust thresholds for mergers. The implications of this deal are profound, with experts debating whether it will enhance consumer choice or result in increased prices.

Netflix’s lawyers are expected to argue that their market share, when considering rivals like YouTube, is not as dominating as it seems. Additionally, they may downplay Warner Bros. Discovery’s streaming viability, focusing instead on its capabilities as a production studio.

However, Trump’s commentary hints at potential political motivations behind the scrutiny. He has praised Netflix’s co-CEO Ted Sarandos, calling him “a great person” and commending his achievements in the film industry. Notably, Trump reportedly favored a competing bid from Paramount to acquire Warner Bros., which could complicate the administration’s stance on the Netflix merger.

Amidst growing tensions, Paramount’s CEO David Ellison previously referred to having a “Trump card” in support of his bid for Warner Bros. This connection raises questions about whether political alliances will influence regulatory decisions on this high-stakes merger.

Despite uncertainties, Netflix remains confident, having included a $5.8 billion breakup fee in their agreement, indicating strong belief in regulatory approval. This fee signifies that Netflix is prepared to pay if the deal collapses for any reason, underscoring the high stakes involved.

The merger’s fate hangs in the balance, with regulatory evaluations expected to unfold over the next few years. The deal may not finalize until late 2026 or even into 2027, leaving ample opportunity for developments and negotiations.

As this situation develops, industry experts and consumers alike are left to ponder the future of streaming and its impact on content availability, pricing, and market dynamics.

Stay tuned for real-time updates on this unfolding story, as Netflix and Warner Bros. Discovery navigate the potential hurdles ahead. Follow us for breaking news, analysis, and expert opinions that matter to you.