UPDATE: Homeowners, it’s time for your annual real estate checkup! As December approaches, now is the crucial moment to assess your property’s value and ensure your financial well-being for the year ahead. Whether you own a home or are considering your first investment, immediate action can significantly impact your financial future.

For those yet to invest in real estate, the question is simple: Do you own property? If not, 2025 is the year to start. Meeting with a Realtor® now can set the stage for your first purchase, maximizing your potential for retirement income.

If you’re already a homeowner, take these urgent steps to ensure your investment continues to align with your financial goals:

1. **Get a Market Analysis**: The real estate market in Boulder has shown significant long-term appreciation. In 1978, homes in Baseline Subdivision sold for under $30,000; today, they start around $750,000. Update your home’s value annually to inform your financial planning.

2. **Review Your Insurance Coverage**: With rising building costs post-Marshall Fire, reviewing your insurance is critical. Ensure your coverage aligns with current replacement costs, and consider additional protections like flood insurance to safeguard against unforeseen events.

3. **Check Your Loan Balance**: If you have an amortized loan, your balance decreases each month. Understanding your current loan balance is essential for determining your equity and planning your financial future.

4. **Evaluate Mortgage Insurance**: Many homeowners purchased with low down payments, leading to Private Mortgage Insurance (PMI). With rising property values, you may qualify to eliminate PMI, lowering your monthly payments. Contact your lender to explore your options.

5. **Review Interest Rates**: As interest rates have dropped in 2025, now is a good time to check with your lender. Refinancing could significantly reduce your monthly payments. Explore options to recast your loan to keep your remaining term.

6. **Decide on Loan Terms**: If refinancing, consider your preferred loan term. A 15-year loan can accelerate principal reduction, but payments will be higher. Discuss your options with your lender to find the best fit for your financial situation.

7. **Consult Real Estate Professionals**: Having the current value and loan balances allows for informed discussions with real estate and lending professionals. If your family has grown, consider refinancing or cash-out options to secure a larger home while building your real estate portfolio.

8. **Schedule a Home Inspection**: Regular home inspections can identify potential issues early, saving you from costly repairs down the line. Ensure your property’s condition is maintained to protect your investment.

9. **Investigate Home Warranties**: Home warranties can cover essential systems in your home, providing peace of mind against unexpected failures. Explore options that fit your needs and budget.

Don’t delay—start your real estate checkup today! Reach out to your Realtor®, lending professional, and home inspector to secure your financial future.

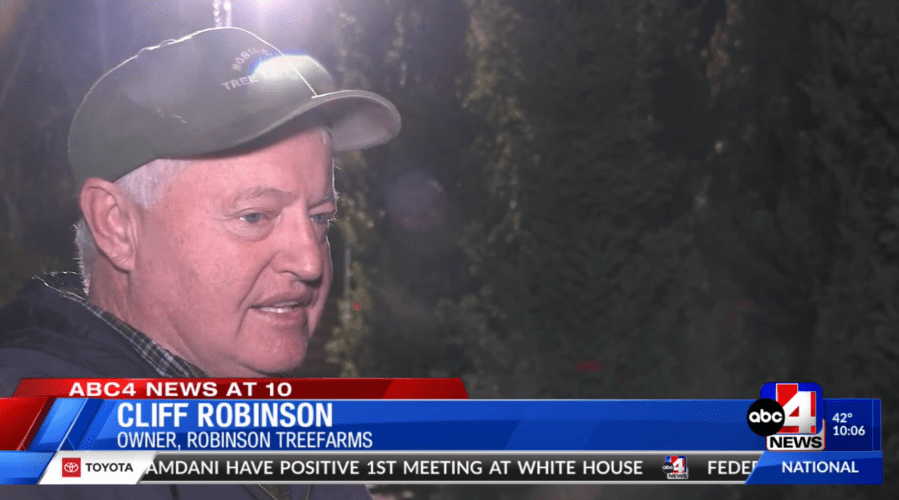

With over 3,000 transactions and decades of experience, Duane Duggan, a seasoned Realtor® at RE/MAX of Boulder, provides expert insights into maximizing your real estate investment. Contact him at [email protected] for personalized guidance.

Stay informed with the latest real estate trends and news through atHome Colorado, your source for insights into real estate, design, and community developments. Don’t miss this opportunity to act—your future self will thank you!