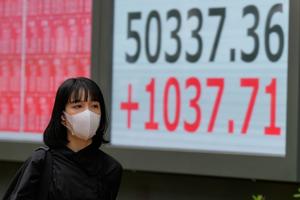

Asian markets experienced a significant upswing on Monday as investors reacted positively to U.S. President Donald Trump‘s comments regarding a potential trade agreement with China. The optimism surrounding the trade discussions contributed to a mixed performance in European stock markets, with some indices moving slightly lower.

Japan’s benchmark index, the Nikkei 225, soared by 2.5% to close at 50,512.32, marking a new record high. This surge came after reports indicated that Trump and Chinese President Xi Jinping had reached an initial consensus ahead of a crucial meeting scheduled for later this week. In contrast, Germany’s DAX inched up by 0.2% to 24,279.53, while the CAC 40 in Paris saw a slight decline of 0.1% to 8,218.42. The FTSE 100 in Britain also fell by 0.1%, closing at 9,640.12.

Trump’s remarks followed his visit to Malaysia, where he participated in a summit of Southeast Asian nations and discussed preliminary trade agreements with Malaysia, Thailand, Cambodia, and Vietnam. He expressed confidence in reaching a deal with China, stating, “I have a lot of respect for President Xi… I think we’re going to come away with a deal.” Such statements have bolstered investor sentiment, particularly in Asia.

The positive market response extended to Chinese stocks as well. The Hang Seng index in Hong Kong rose by 1.1% to 26,434.69, while the Shanghai Composite increased by 1.2% to 3,996.94. Stephen Innes, managing partner at SPI Asset Management, noted, “This isn’t just photo-op diplomacy. Behind the showmanship, Washington and Beijing’s top trade lieutenants have quietly mapped out a framework that might keep the world’s two largest economies from tearing up the field again.”

As Trump continued his Asia tour, he is expected to conclude his trip in South Korea, where he will meet with Xi on the sidelines of the Asia-Pacific Economic Cooperation (APEC) forum. The potential for a trade deal is particularly significant for South Korea, as reflected in the Kospi index, which climbed 2.6% to reach 4,042.83, a new record.

In Japan, the newly appointed Prime Minister Sanae Takaichi has garnered strong public support for her market-friendly policies. Takaichi has indicated a willingness to increase defense spending, which has positively influenced the stock performance of major defense contractors. For instance, Kawasaki Heavy Industries saw its shares rise by 9%, while IHI Corp. and Hitachi gained 2.8% and 3.7%, respectively.

Despite the positive sentiment surrounding potential trade agreements, a report from the APEC secretariat cautioned that annual growth in the Pacific region is expected to slow to 3% this year, down from 3.6% last year. This decline is attributed to ongoing trade restrictions and elevated tariffs.

On Wall Street, U.S. stocks reached record highs on Friday, buoyed by encouraging inflation data that eased concerns for investors. The S&P 500 rose by 0.8% to 6,791.69, surpassing its previous all-time high. The Dow Jones Industrial Average increased by 1% to 47,207.12, and the Nasdaq Composite climbed 1.1% to set a new record at 23,204.87. This positive economic outlook is particularly important for lower- and middle-income households facing rising prices and may allow the Federal Reserve to continue cutting interest rates.

Shifting focus to commodities, U.S. benchmark crude oil prices fell on Monday, with a decrease of 66 cents to $60.84 per barrel. Meanwhile, Brent crude, the global standard, declined by 67 cents to $64.53 per barrel. The U.S. dollar traded at 152.77 Japanese yen, slightly down from 152.85 yen, while the euro rose marginally to $1.1639 from $1.1636.

The developments surrounding U.S.-China trade relations continue to influence global markets, with investors remaining optimistic about potential agreements that could stabilize international trade dynamics.