Huntington Ingalls Industries (HII) has significantly expanded its facility in Portchester, England, to enhance its capacity for producing unmanned underwater vehicles (UUVs) for the United Kingdom’s Royal Navy and other European naval forces. This strategic move, announced on March 12, 2024, underscores HII’s commitment to meet the growing demand for advanced maritime technology in western and northern Europe.

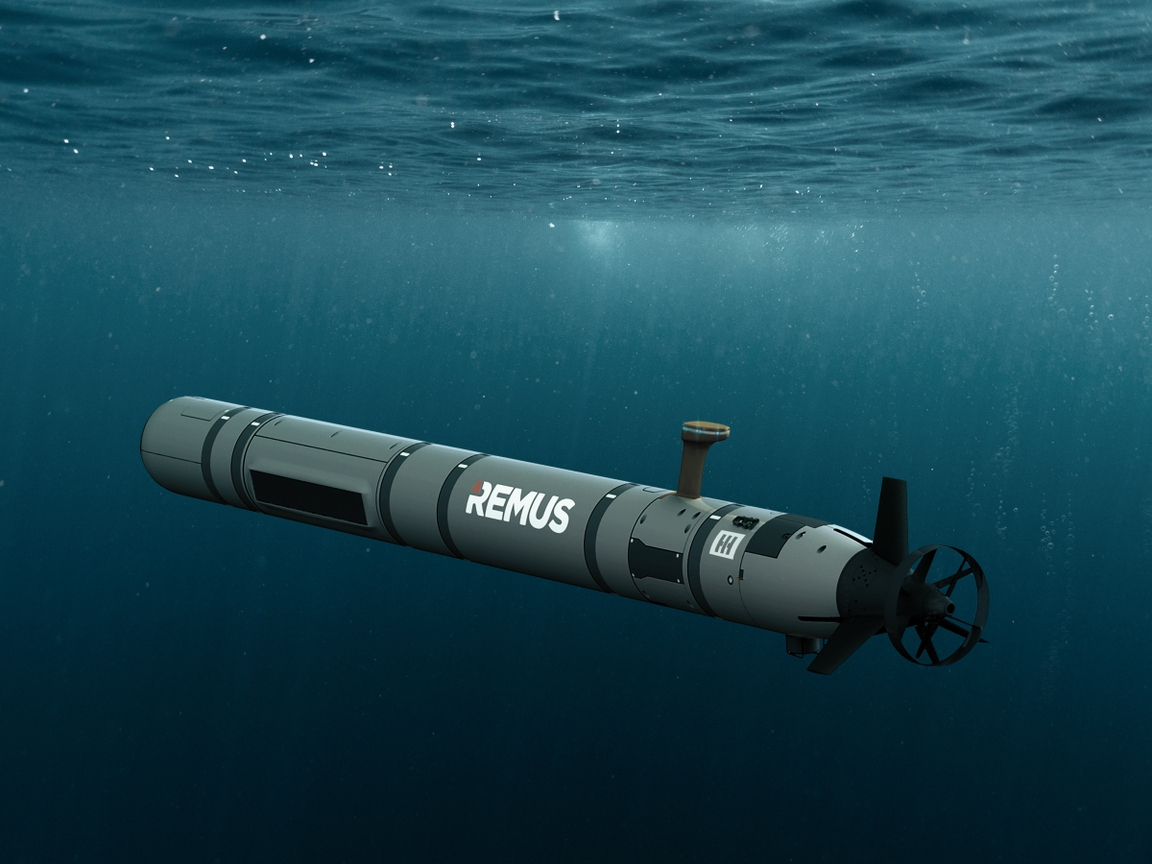

The enlarged site will facilitate the assembly of the Remus 620, a medium-class modular UUV, and increase training capabilities for allied navies, according to Nick Green, the facility manager. In a briefing with reporters, Green noted that advancements in technology have led to larger UUV orders, such as those of 10 to 15 units, compared to previous orders of just one or two.

Growing Demand for Unmanned Systems

As European NATO members, including the U.K., the Netherlands, and Belgium, transition from traditional crewed minehunter vessels to advanced unmanned systems, the demand for effective mine countermeasures has surged. “The demand is there, the requirements are there as the technology is improving, the sensors are improving, and the capabilities are improving,” Green stated. This shift is expected to expand the market for UUVs significantly.

The Royal Navy has been utilizing Remus systems since acquiring its first two vehicles in 2001 for mine warfare. Today, the Navy operates a diverse fleet of models, and the new facility in Portchester is set to bolster HII’s ability to fulfill maintenance contracts for the Royal Navy. The company reports that its Remus systems are currently operational in over 30 countries, including 14 NATO members, and are gaining traction among European nations such as Germany, Norway, and Sweden.

Strategic Partnerships and Future Developments

HII’s president of the Unmanned Systems group, Duane Fotheringham, highlighted the ongoing robust interest in mine countermeasures and noted that increased defense budgets will further drive sales in this sector. Despite rising competition in the UUV market, Fotheringham expressed confidence in HII’s preparedness, citing the open architecture and modularity of Remus vehicles, which allow for seamless updates to software and hardware.

The flexibility of UUVs extends beyond mine detection. As Green pointed out, long-range patrol capabilities are becoming increasingly relevant for safeguarding critical infrastructure amid evolving seabed warfare requirements. “The payloads that we are developing and putting onto these vehicles at this time allow for future capability coverage,” he remarked.

HII is committed to enhancing its production capabilities within the U.K. where feasible. This includes the assembly of the Remus 620 and the development of launch and recovery systems. Green emphasized the importance of U.K. content for U.K. contracts, stating, “We believe that U.K. content for U.K. contracts is more and more important, and a big part of what we can offer as a mature UUV-USV supplier.”

The company has also been collaborating with Babcock to test the torpedo-tube launch and recovery capabilities of the Remus 620, utilizing technology already employed by the Royal Navy’s submarines. Most repair and maintenance activities for U.K. and many European customers will now be centralized in Portchester, minimizing the need to transport equipment between the U.S. and Europe.

HII has delivered over 750 UUVs in the Remus family, with the Remus 100 model being particularly popular, boasting more than 400 units sold globally. The Portchester facility will also serve as a support base for the forthcoming Romulus family of unmanned surface vehicles, with HII actively testing various configurations in the United States.

Looking ahead, HII plans to launch a 190-foot Romulus platform by the end of 2026, with intentions to showcase these systems to the Royal Navy and other European clients. This expansion not only positions HII to meet the immediate needs of its customers but also sets the stage for future advancements in unmanned maritime technology.